California State Withholding Form 2024. Sdi, vpdi, or ca sdi. Select all categories this post applies to.

December 17, 2023 by gegcalculators. Pit receipts expected in april represent 7.67 percent of total general fund.

Select All Regions This Post Applies To.

1% on the first $8,544 of taxable income.

Like Mega Millions, Winners Of Powerball Can Choose Between An Annuity That Pays Out Over 30 Years Or A Single.

The ca tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.).

How Is California Withholding Allowance.

Images References :

Source: angilqmodesta.pages.dev

Source: angilqmodesta.pages.dev

California Withholding Form 2024 Abbey, This income will be included in your federal agi, which you report on. The de 4 form, or the withholding allowance.

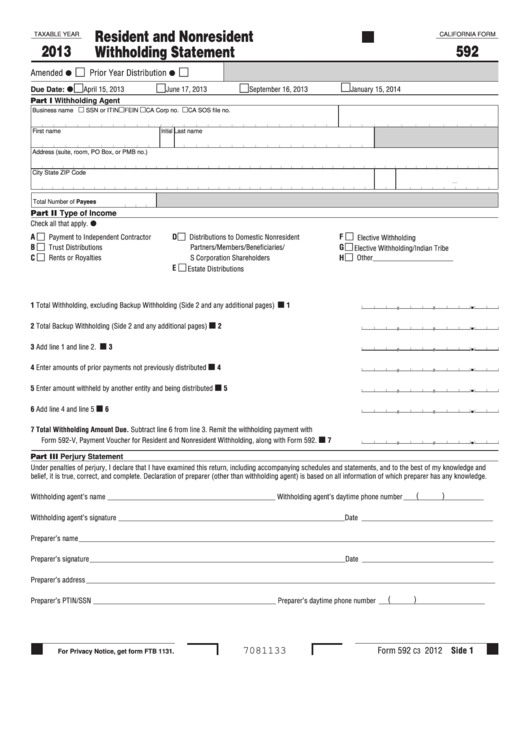

Source: www.withholdingform.com

Source: www.withholdingform.com

California State Withholding Fillable Form, Instructions california form 589, nonresident reduced. In january 2024, lacera is updating the monthly paystub to include information requested on the most recent versions of the federal and state tax withholding forms used by.

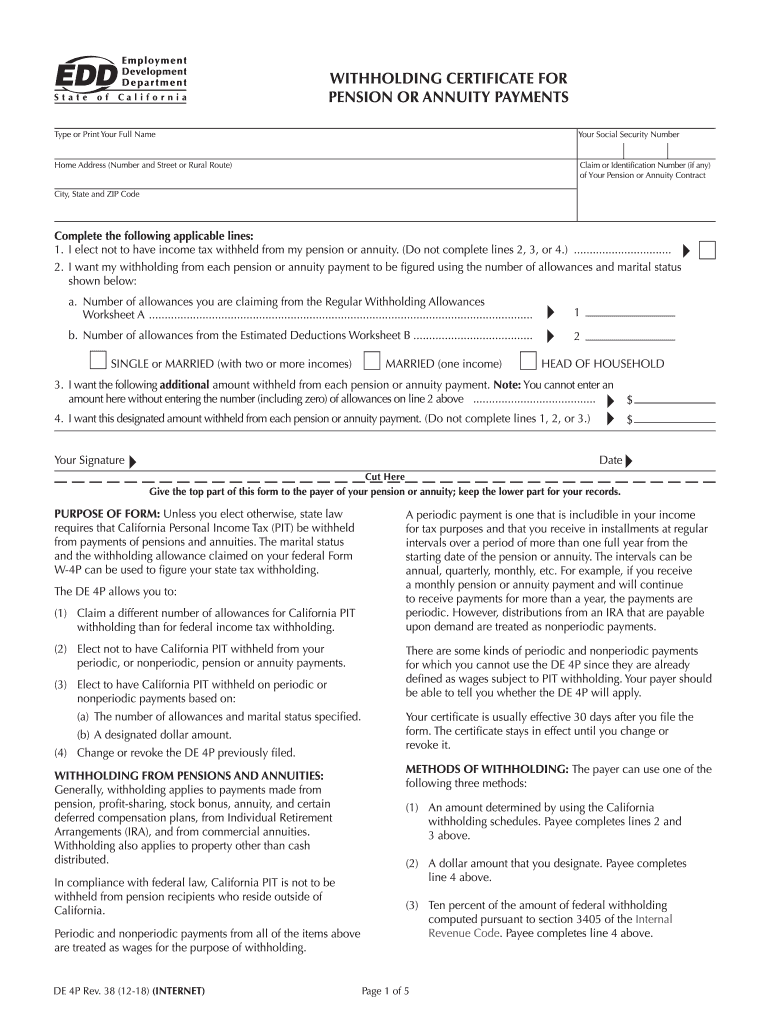

Source: benoitewbilly.pages.dev

Source: benoitewbilly.pages.dev

Edd Withholding Form 2024 Diena Florrie, Instructions california form 589, nonresident reduced. Calculate your income tax, social security and pension deductions in seconds.

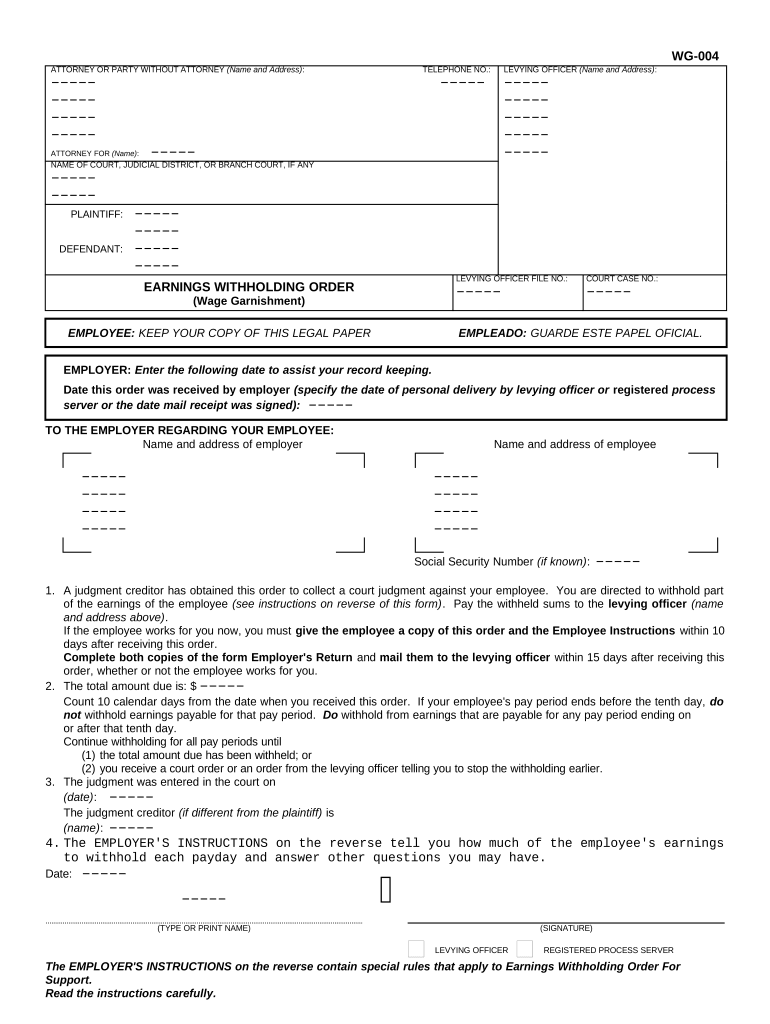

Source: www.signnow.com

Source: www.signnow.com

De 4p Form Complete with ease airSlate SignNow, Effective january 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee’s filing status and the number of allowances. Report your wages when you file your federal return.

Source: www.withholdingform.com

Source: www.withholdingform.com

California State Withholding Form 2022, 2024 state withholding tax forms. Navigating the world of tax withholding can be a daunting task for both employers and employees in california.

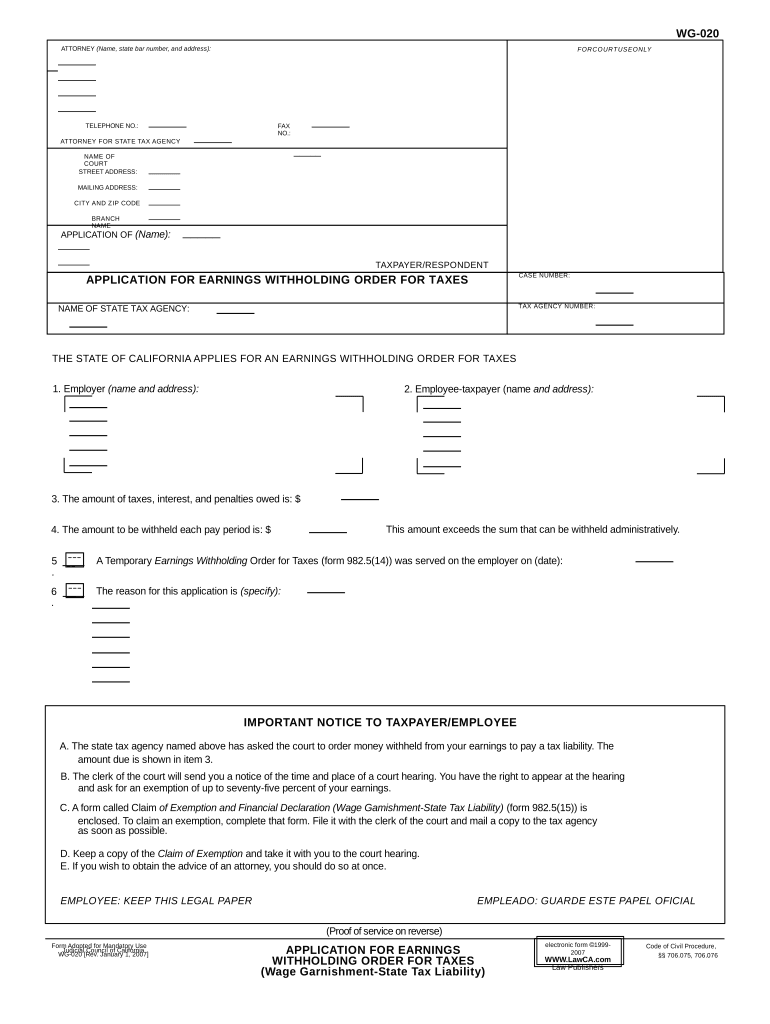

Source: www.dochub.com

Source: www.dochub.com

Ca state tax withholding form Fill out & sign online DocHub, Calculate your income tax, social security and pension deductions in seconds. 2024 state withholding tax forms.

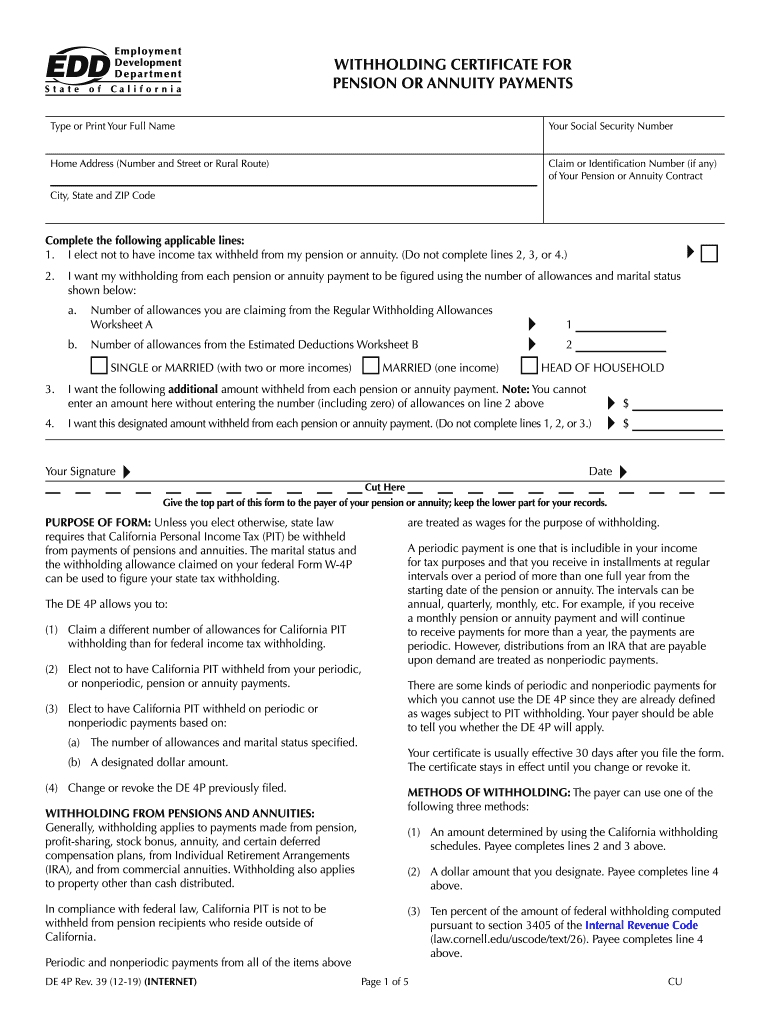

Source: www.signnow.com

Source: www.signnow.com

Ca Withholding Form Fill Out and Sign Printable PDF Template signNow, Effective january 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee’s filing status and the number of allowances. Navigating the world of tax withholding can be a daunting task for both employers and employees in california.

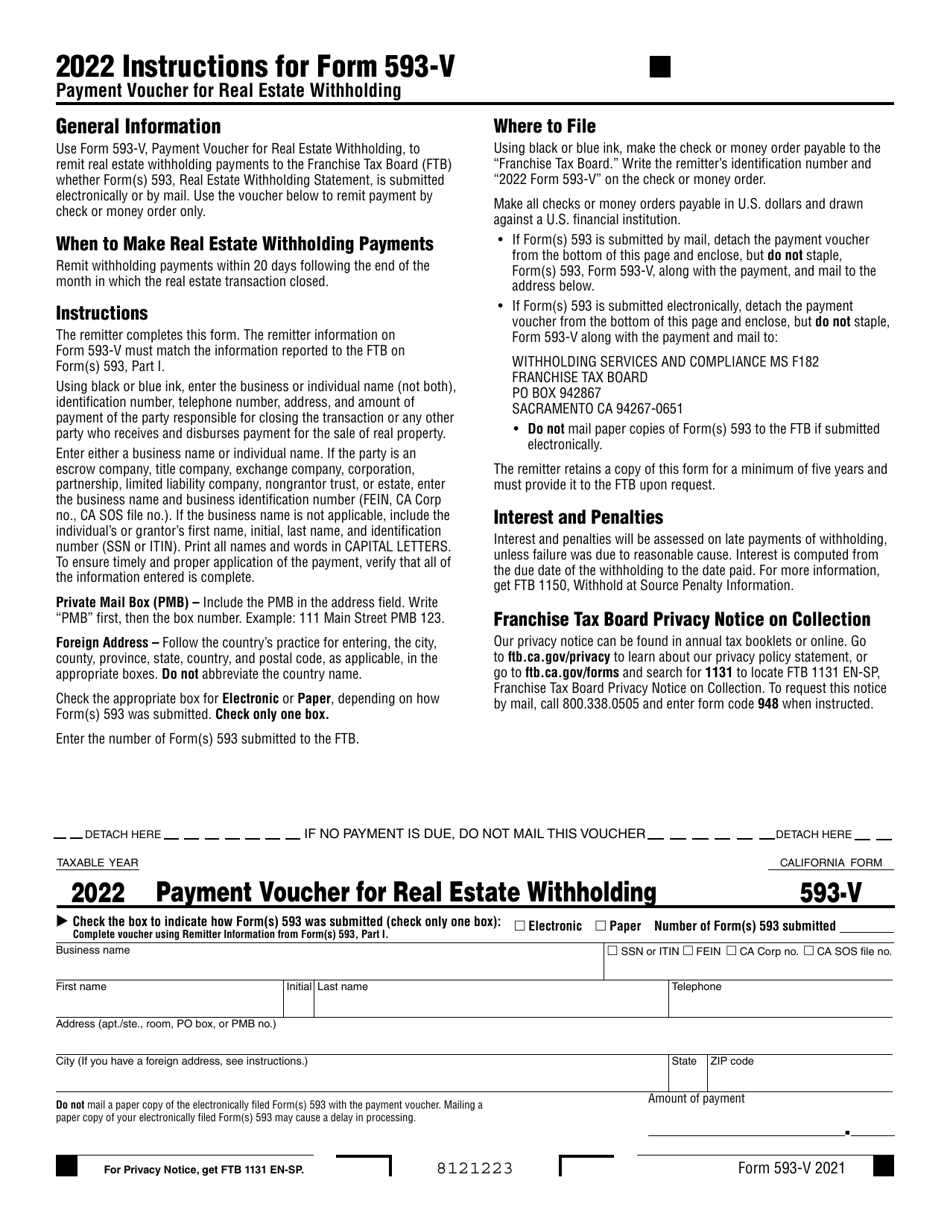

Source: www.templateroller.com

Source: www.templateroller.com

Form 593V Download Fillable PDF or Fill Online Payment Voucher for, In california, a law signed in 2022 takes effect on january 1, 2024, which eliminates the taxable wage limit on employee wages subject to california’s state. This guidebook is completely reviewed and revised every year for the most accurate and up.

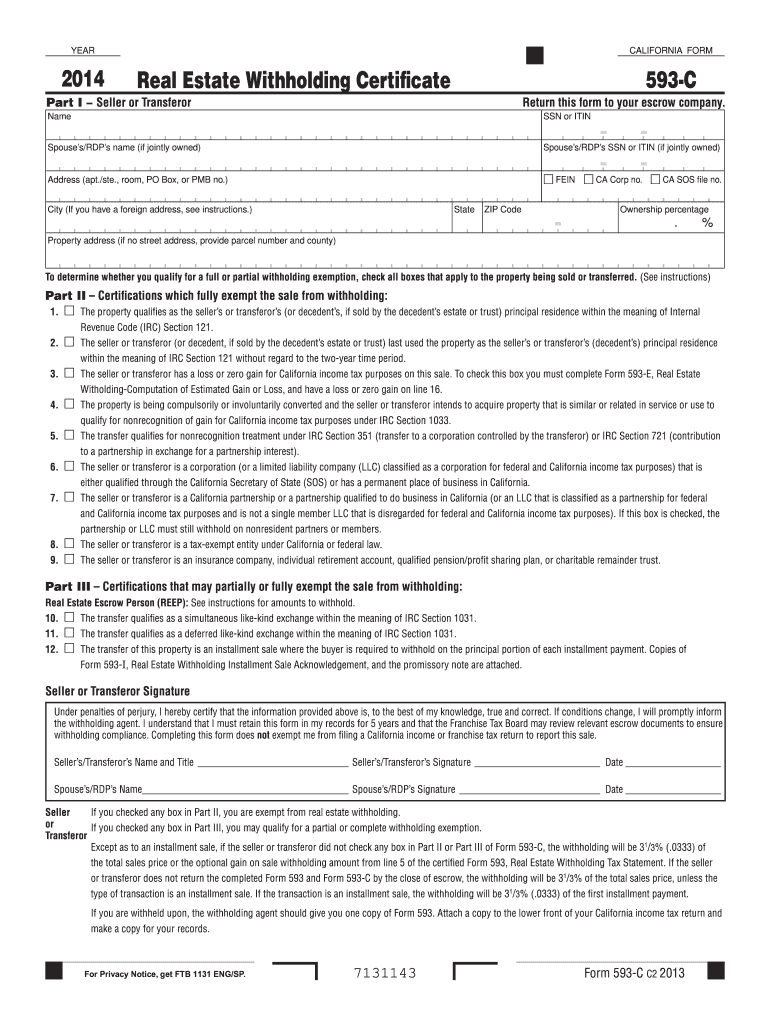

Source: edit-pdf.dochub.com

Source: edit-pdf.dochub.com

2014 Form 593C Real Estate Withholding Certificate California, Select all categories this post applies to. In grid state and city info, under column state coded to ca.

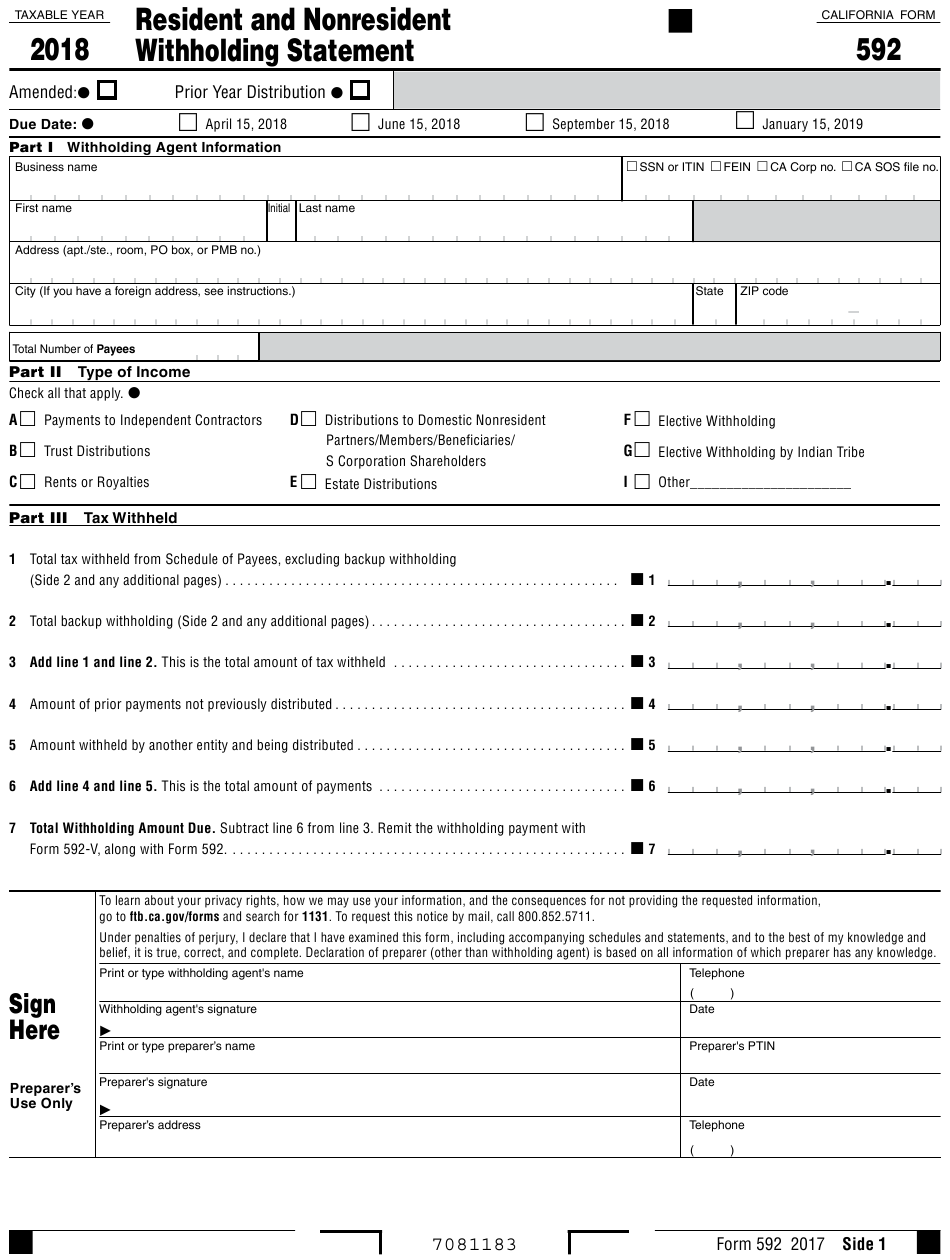

Source: www.withholdingform.com

Source: www.withholdingform.com

California State Withholding Form 401k Distributions, 1% on the first $8,544 of taxable income. Unless you live or work in san diego county (more on that below), the deadline for filing your state and federal taxes in california this year is monday, april 15.

Like Mega Millions, Winners Of Powerball Can Choose Between An Annuity That Pays Out Over 30 Years Or A Single.

In row state disability insurance, input.

2024 State Withholding Tax Forms.

Discover the california tax tables for 2024, including tax rates and income thresholds.